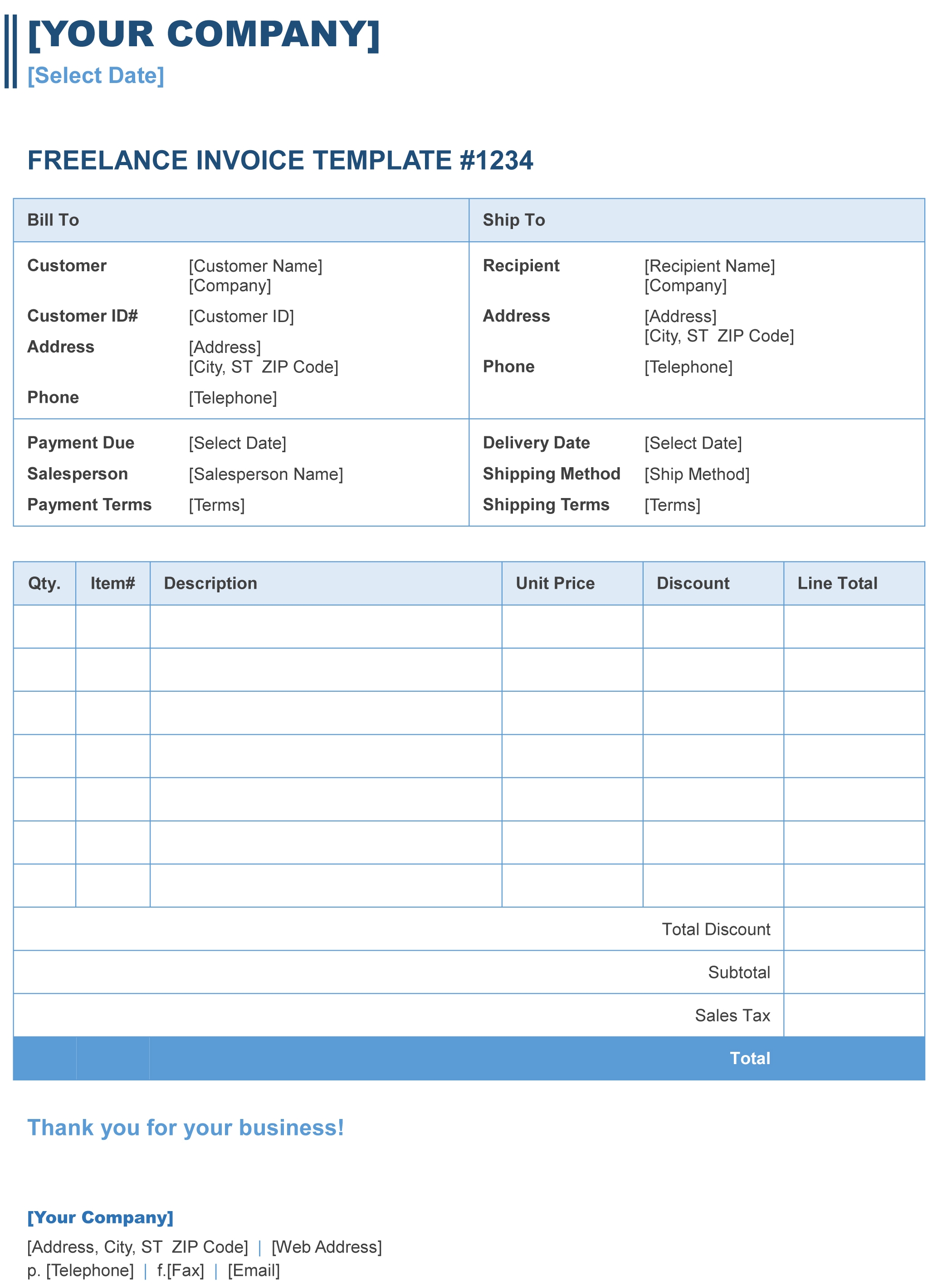

While additional payment types can make life easier for your customers, keep in mind that they’re less straightforward from a bookkeeping perspective.

If you plan to offer those payment types, you’ll want to ensure your solution can handle those sales. Some e-commerce platforms are equipped to track sales that come from cash, check, and gift cards, in addition to credit. Most of the payments you receive will be through customer credit cards versus other forms of payment, but you can still choose to accept other payment types (especially if you also sell in-person). Important Things to Consider for E-Commerce Bookkeeping If you want to keep better books, Try Pilot Now.

#Freelance bookkeeping sales template plus#

Plus we dive into three key features you should look for in a bookkeeping solution for your e-commerce business.Īt Pilot, we have a team of expert bookkeepers using unique tools who can handle the most difficult e-commerce bookkeeping situations. In this article, we explain seven essential considerations for e-commerce bookkeeping. That way, your records and financial statements (like your Balance Sheet and Statement of Cash Flows) are accurate and complete, so you can make sound financial decisions for your store. Whether you do your own bookkeeping with accounting software, hire a professional bookkeeper, or work with a bookkeeping service, your solution should be equipped to deal with the intricacies of e-commerce bookkeeping, including: Your bookkeeping solution needs to be able to keep up. From calculating taxes on online sales to inventory management to figuring out shipping logistics, running an online store comes with a whole host of challenges and considerations.

0 kommentar(er)

0 kommentar(er)